In March, the Institute for Higher Education Policy published a study on college affordability in the United States. The report, titled Limited Means, Limited Options: College Remains Unaffordable for Many Americans highlights the growing upfront cost of attending university in the United States.

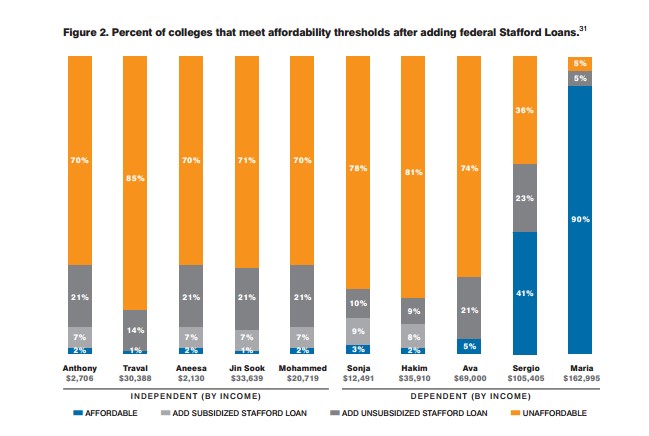

Their key finding after analyzing price data for 2000 colleges was that federal aid policies aren’t doing enough to ensure anything approaching equal access. The current mixture of grants, federally subsidized loans, and loan forgiveness programs are not sufficiently funded to close the opportunity gap between low income and high income students. One reason the study suggest this may be, is that there is a basic lack of understanding with regards to how widely each student’s sense of affordability varies.

The study attempted to show this by assessing what colleges were accessible to what students, accounting for differences in wealth, family background, status as a dependent. The researchers measured cost of attendance by net price (cost of attendance minus grant aid) and compared these using Lumina Foundation’s Affordability Benchmark based on discretionary income. To account for the options each student faces, the researchers created student profiles which were representative of the income levels and dependency status of the college applicant population in the U.S.

The researchers determined that the cost of attendance is increasing, while it is becoming harder to cover costs using student loans. In fact, the researchers determine that even with subsidized student loans, low income students rarely gain much flexibility in their choice of college and now face loan payments. In that way, affordability still entirely depends on one’s starting place.

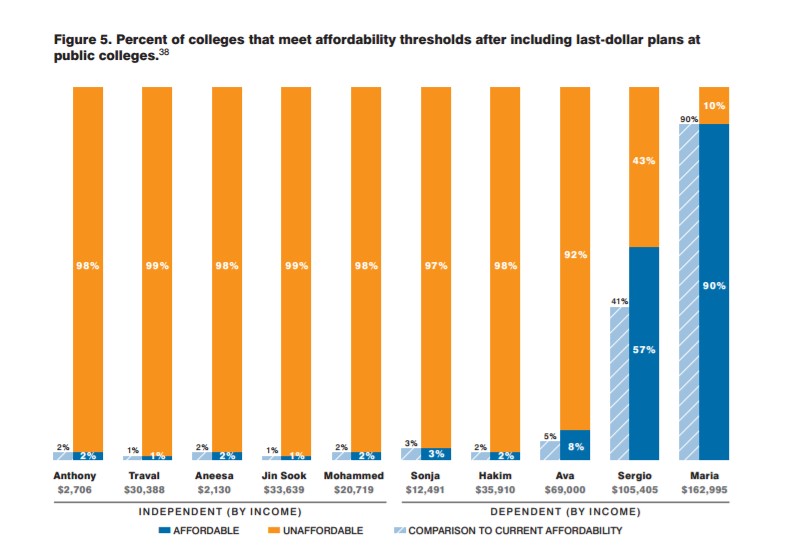

As we’ve seen in class, the rising cost of higher education in Asia is associated with privatization in the sector. Perhaps the most telling finding of this U.S. study then, is that if all publically funded universities moved to free tuition, low-income students would face the same options of affordable colleges.

The study warns that the issue of affordability in U.S. education is being improperly framed as a question of value. The logic is that if a degree promises sufficient future returns, the cost is bearable, particularly if paid in small installments as is typical of a student loan. For many however, the study shows that the initial cost of attendance is too high a barrier to entry to even consider the long-term value of the credential.